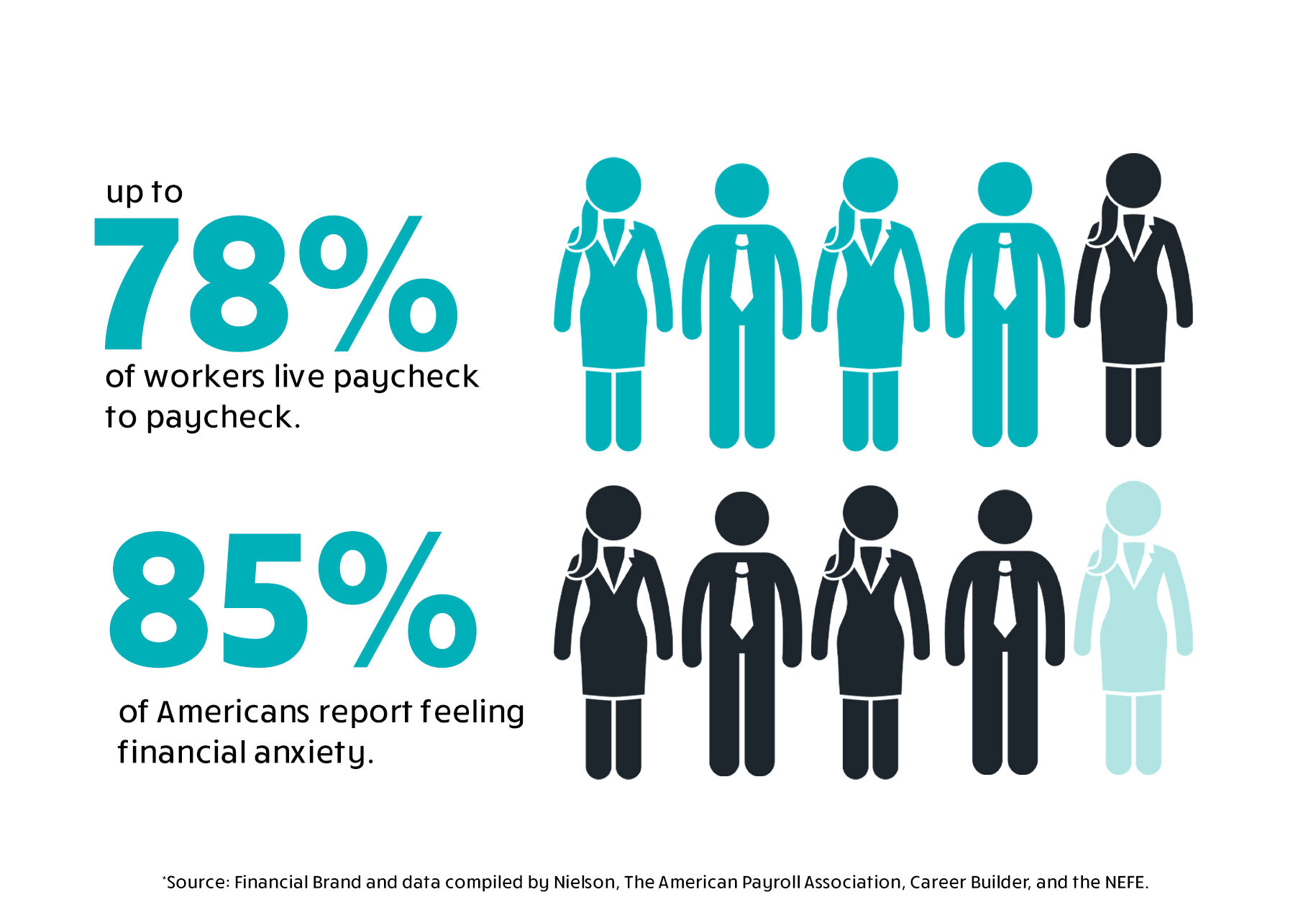

Financial stress can affect the workplace environment.

Research shows that financial stress can take a toll on workplace

productivity and can affect your company’s overall success.

Financial stress can lead to distractions at work and absenteeism. Rave Financial is here to provide resources to help your employees

ease financial insecurity and improve their financial well-being.

Benefits of Becoming a Rave Financial Partner:

How We Can Help Your Employees.

Your employees need to feel confident in their finances, and we're here to ensure they do. We are a member-owned, not-for-profit cooperative focused on the wellbeing of our members. We offer competitive rates, financial health resources, and innovative solutions to ensure our members make confident and smart financial decisions.

- Receive direct deposit up to 4 days early

- Complimentary Credit Score Analysis

- Low balance transfer rate for the life of the balance

- Build your credit with our Secured Platinum Credit Card

- $1,500 Express Loan with no credit check*

- Financial Education seminars On-site and virtual

*Subject to credit approval. Express Loans have a repayment term of 12 months. Annual Percentage Rate (APR) is 17.70%. One offer per member. A $40 application fee will apply. Offer may expire without prior notice. Some restrictions apply. Early access to direct deposit funds depends on the timing of the submission of the payment file from the payer. We generally make these funds available on the day the payment file is received, which may be up to 4 days earlier than the scheduled payment date. We are dependent on the timing of your payor’s payment instructions and therefore you may not always see your direct deposits arrive early. This feature only applies to ACH payments crediting your bank account. This feature is not eligible on debit cards.

Spend. Save. Thrive.

5.9% APR on all balance transfers for the life of the balance!

Announcements

- Name Change FAQs

- 2024 Holiday Closings

- Escheatment Notice

- USPS Mail Delays

- Digital Banking Security Tips